Imagine you have 60 seconds to win that $1m contract and your dream

audience is standing next to you in an elevator.

Could you do it?

I recently had the pleasure of sitting with the team at Access Granted to do a podcast interview. At the end of the interview they asked for my elevator pitch for Fuelled.

I instantly froze and thought ‘why haven’t I prepared this?!’ After awkwardly bumbling away for a few minutes I finally managed to spurt out ‘Fuelled turns outstanding invoices into cash’. Face in hands, I was so disappointed in myself. I had wasted a perfect opportunity and could have done so much better had I been prepared.

Moral of the story – Don’t Be a Donna.

Having an ‘elevator pitch’ is crucial when it comes to thinking on your toes about your business offering. It’s the promotional pitch you use to tell people about yourself or your brand in the same amount of time it would take to ride an elevator.

There are endless opportunities to casually strike up a conversation about what it is that you do. So cue the Elevator Pitch!

Simple right?

Well, while it may sound simple to prepare an elevator pitch, there actually seem to be a few rules!

• Practice it but don’t preach it

• Keep it professional but not boring

• Cover all your points but keep it to the point

• Tell a story but not a novel

• Sell yourself but don’t over sell it

Feeling confused?

Well you are not alone! However, when putting my Fuelled elevator pitch together I did discover that the less confusing approach is to share your ‘Why’ not your ‘What’.

In her blog, Jules Schroeder from Forbes.com talks about a shift in business culture where people are buying based on ‘Why’ you do what you do rather than ‘What you do’.

Simply put, Jules’ advice was to prepare a short and a long elevator pitch; one for the first-floor ride and one for the multiple floor ride and no more than 30 to 60 seconds long.

She gives an overview of how you should construct your pitch:

Introduce yourself

Connect with your audience with something relatable by addressing the problem right straight away.

Mix in a bit of the ‘how’

End with a call to action

So, after reading Jules’ blog I’ve started to piece together my short elevator pitch and thought I’d share it with you. It still requires some furness and tweaking along the way but thats part of the journey.

‘I’m Donna, I work as the Head of Operations and Product Development at Fuelled.

Fuelled came to life as we could see how stressed business owners had become by cash flow gaps in their business. They are anxious about long payment terms, seasonal demands and looming tax just to name a few. Having cash tied up in unpaid invoices means they can’t take advantage of growth opportunities.

We wanted to take away these worries so came up with a smart way to plug the gaps by lending money against their unpaid invoices by using a online system that they could acess at anytime.

No one wants the 3rd degree or waste time in boring meetings so we made it easy to sign up for free via our website.

Donna SorsaRemember, being perfectly imperfect is ok. Each time you use your elevator pitch see how your audience reacts.

- Did they understand why you do what you do?

- Did they say ‘Oh I know someone who could use that service’ or ‘that’s a great idea’. Or

- Did they stare at you blankly, fall asleep briefly or excuse themselves to the bathroom!

So dont be a Donna, be prepared, and enjoy the ups and downs of constructing your own elevator pitch!

Donna Sorsa

Operations & Product Development

Donna can be described as ‘Perfectly Imperfect’. [email protected]

Podcast with Access Granted NZ

Balanced by Humanature

Say goodbye to 30|60|90 day payment terms

Fuelled helps small businesses grow by funding their outstanding invoices online. No meetings, no personal guarantees, no third degree.

The post The Ups and Downs of the Elevator Pitch! appeared first on Fuelled.

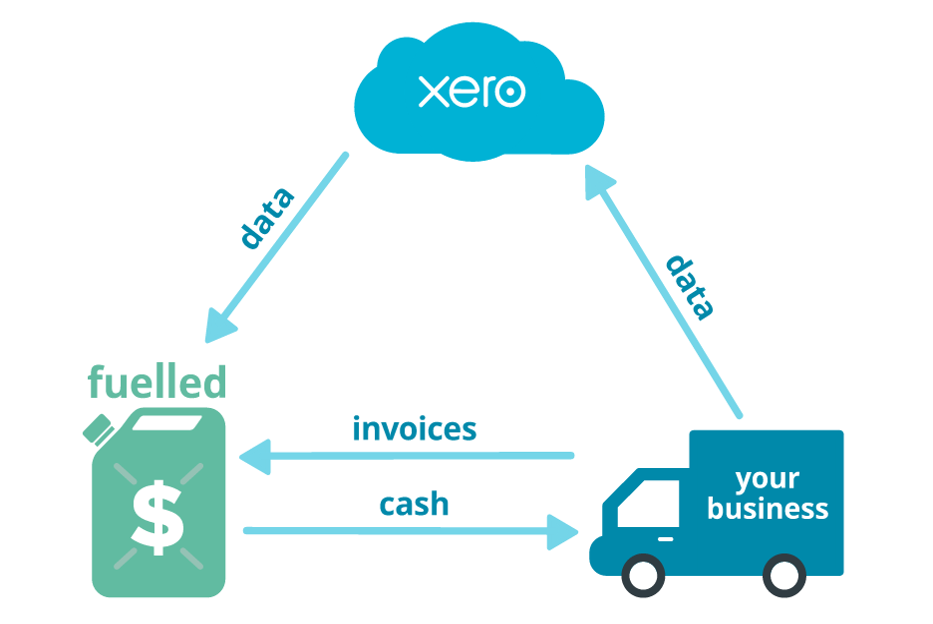

]]>At Fuelled we’re proud of our partnership with Xero to make cash flow management easier for small and medium-sized enterprises (SMEs).

Our solution gives SME owners a simple way to fix their cash flow problems by advancing invoices.This can be done safely and securely from a computer in a matter of minutes.

Read more about Fuelled + Xero

What is invoice financing?

What does ‘advancing invoices’ mean I hear you ask?

Well, the business model is called ‘Invoice Financing’ and it’s an oldie but a goodie.

The official definition is this: “Invoice financing is a way for businesses to borrow money against their outstanding customer invoices.

Invoice financing helps businesses improve cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they had to wait until their customers paid them.”

At Fuelled we have used technology to make the service fast and convenient by integrating the Fuelled platform with Xero.

No more time wasted filling in forms or printing out your accounts to send on to the bank.

How does it work?

Creating a Fuelled account is free and you find out in a matter of seconds whether you qualify for the service, how much cash you can free up, and what the total cost is per invoice.

You can use Fuelled only when you need it; no lock-in to long term contracts or monthly fees. It is an everyday tool available to you when you need extra cash to pay bills or accelerate your growth.

So how does it work in practice? Put simply, you create your account and authorise Fuelled to read your Xero data.

Our platform does an immediate credit analysis and, if you qualify, lists the invoices that meet our criteria. You choose the invoices you want to fund, we provide a quote, and you click submit.

If this is your first invoice, there is some additional information we need to collect, mostly due to regulatory reasons (such as anti-money laundering legislation).

You typically receive the funds in your account the same day. The service is confidential and doesn’t interfere with your customer relationships.

‘Faster, Better, Smarter’

It doesn’t cost you anything to find out if Fuelled funding is available to you so that when the day comes that you’re running low on funds, you can login to Fuelled and release cash tied up in your unpaid invoices.

I suggest you give it a whirl! Introduction to Fuelled video

Tapio Sorsa

CEO & Co-Founder

Tapio is known as our Tall Finn or the Finniwi.

[email protected]

Introduction to Fuelled video

Podcast with Access Granted NZ

Say goodbye to 30|60|90 day payment terms

Fuelled helps small businesses grow by funding their outstanding invoices online. No meetings, no personal guarantees, no third degree.

The post Xero waiting time with a Fuelled cashflow solution appeared first on Fuelled.

]]>It’s a well known fact that every great business has a website. But not every business has a great website.

Like any business getting a great website up and running can be like staring at a blank piece of paper; daunting!

So, we wanted to share the process of refreshing our website to take away some of the ‘argh’ factor.

Our Fuelled team always works hard to keep pace with what is important to our community of New Zealand businesses. We knew we needed to provide our customers with a faster, more efficient online journey that would take them through what we offer, why it benefits their business, who we are and how it all works.

Ultimately, we wanted to make sure our customers could get a solution to their cash flow challenges quickly and easily and our website needed to be the first port of call.

So how did we determine what was important to our customers?

Working with our wonderful digital agency and using our previous website as a learning tool, we discovered the information that was most important to our customers by looking at the analytics, user behavior, customer feedback and heat maps and applying it to a new design.

“The real story lies in the true ‘Why’.

Those meetings around the kitchen table, the frustration of knowing things can be done better and having to wake up every day in a world where businesses can’t get the help they need, you are the crusaders coming to save kiwi companies from the cash flow monster.

That’s the story I want to know about, that’s how you build trust.”

What a learning curve! Amongst it all we discovered our customers mostly wanted to know about four main areas and they all revolved around the speed they could access the information they need and trust such as pricing!

Here’s what our customers wanted:

- Answer my questions faster!

We took the top seven questions we were constantly asked or that were searched for in our FAQ’s and made sure that content was available up front.

- Who am I dealing with?

Our customers wanted to be able to trust us and wanted to know who is behind the Fuelled brand. We decided to shout out that we are proud to be New Zealand owned and operated and backed by Xero and Heartland Bank, both great household Kiwi brands.

- Who is using the Fuelled service?

Success stories are the key to our customers being able to relate to other businesses and to trusting in the quality of our service so we needed to make these visible.

- What is Fuelled’s story?It felt strange to tell the world about the late nights and the walls of our houses covered in post-it notes, but these stories gave our customers an insight into the fact we also are a business that started from grassroots. People deserve to know that we are human too. We work hard and have lives that are busy with family, all the while piecing together a solution that would make other lives easier.

Then came time to piece it all together and to give our customers a simple, seamless experience where they could move easily between our website, the online app and communicating with a real person.

We worked hard to ‘speak human’ while educating our visitors; you won’t need an economics or finance degree to use Fuelled because we are there with you the whole way.

Lastly, we are proud to stay true to ‘Our voice’:

- No 3rd degree

- Be Informative

- Build Trust

But the proof is always in the pudding. The first test of our website’s effectiveness starts today.

We need to know that the changes we made make a difference but we’ll always continue to tweak things, run comparative tests and respond to feedback; the good, bad and the ugly.

So, what’s next on our Fuelled agenda?

Watch this space for some blog and social media activity. All aimed to educate and add value to your business. In the meantime, we’d love to know what’s important to you and what you’d like to hear about to really hit the nail on the head! Comment below or feel free to share our posts within your own community.

Our Fuelled journey continues but for now we hope you enjoy our new website.

“You create a credible brand by staying true to who you are.”

– Hillary Sawchuk –

Donna Sorsa

Operations & Product Development

Donna can be described as ‘Perfectly Imperfect’. [email protected]

Podcast with Access Granted NZ

Balanced by Humanature

Say goodbye to 30|60|90 day payment terms

Fuelled helps small businesses grow by funding their outstanding invoices online. No meetings, no personal guarantees, no third degree.

The post Fuelled Up and Ready to Roll appeared first on Fuelled.

]]>20 February 2017

Heartland Bank Limited (Heartland) (NZX: HBL) advises that it has taken a 25% shareholding in

Fuelled Limited, an online small-to-medium business (SME) lender (www.fuelled.co.nz). The

shareholding has been provided alongside a committed debt facility enabling Fuelled to

accelerate its Australasian growth plans.

Fuelled is a New Zealand-based business whose simple on-demand service enables SMEs to

receive an immediate cash advance on their outstanding invoices, rather than waiting up to 90

days for their customers to pay. Fuelled is the first of its kind in New Zealand and has been

selected by Xero as its first alternative lender in Xero’s recently launched Financial Web. This

tight integration with Xero enables Fuelled’s advanced credit assessment engine to make real

time credit and financing decisions. The Fuelled customer experience is fully online and the

entire process takes just a few minutes.

The investment in Fuelled provides Heartland with the opportunity to gain further exposure to

online SME lending, following the launch of Heartland’s Open for Business loan origination

platform for SMEs in 2016 and its recent partnership with Spotcap Australia. Expansion of

Heartland’s digital origination platforms is a key priority for the business and Heartland

welcomes the opportunity to work with an innovative New Zealand company providing a

unique working capital offering for SMEs.

For further information, please contact:

Jeff Greenslade

Chief Executive Officer

Heartland Bank Limited

DDI 09 927 9149

https://www.nzx.com/companies/HBL/announcements/297040

The post Heartland takes shareholding in online lender Fuelled appeared first on Fuelled.

]]>If you’re a small business owner, the one thing that wakes you up at 3am more than anything else is cash flow – or lack thereof.

It is the lifeblood of any business, especially smaller fast growth businesses.

In my experience, most businesses never have enough of it, and cash flow gaps are common; not because the business isn’t financial mature, but because gaps are hard to predict.

Customers pay late, they partial pay, the invoice is disputed…the list goes on.

When I was in my early 30’s I started a technical recruiting business in Seattle during the dotcom boom. It was money for jam – demand was high as were margins, and we grew very fast.

To keep us funded, we had a small term loan tied to the house and a minuscule line of credit, but that was all the banks would give us. We had no track record, no assets and the P&L was weak, so getting flexible credit lines was almost impossible.

In the end we used a factoring service which helped as it allowed us to take on more business, but the customer experience and administrative burden was a nightmare.

Fast forward 10 or so years, and while the breadth of credit and payment options is broader, the problem is still the same. Short-term cash flow gaps abound.

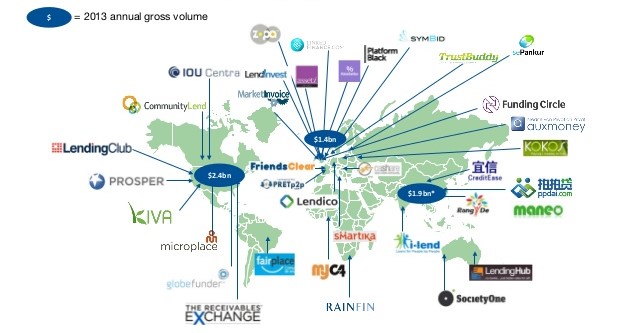

With the whole finance industry being disrupted as I write this, new forms of alternative finance proliferate which can support the small business and provide working capital typically on more flexible terms than the banks.

The Kaplan Group identified alternative finance companies worldwide that fall into three categories: they use technology to enable extremely fast authorization and financing, they use technology to connect crowdfunding and peer-to-peer finance sources, or they offer non-traditional forms of finance[1].

As you can see below, there are a lot of options to choose from and they are growing:

Source: Liberium Capital Limited, 2014

In April 2014, new regulations were introduced in New Zealand to support alternative finance providers. Aimed initially at peer-to-peer and crowdfunding providers, the regulations allow businesses to raise up to $2 million a year through licensed crowd funding websites by issuing shares or other incentives to the public.

To date there are 5 peer-to-peer lenders in New Zealand – mainly focused on the consumer market and primarily offering medium to long-term debt facilities. In addition, there are seven or so crowdfunding providers – providing both debt and equity growth capital for charities and small businesses.

While the growth of alternative finance in New Zealand is encouraging, there is still a gap in the market for flexible financing solutions which address a small businesses short-term cash flow gaps, without tying the business up in onerous covenants, administrative burden and cost.

For the first time, thanks to Xero’s partnership with Fuelled, customers can access an immediate source of finance making the task of managing cash flow easier, as well as providing the means to fund future growth.

“Better decisions, better access to capital, better and more secure data – these are the promises of the financial web that together we are making real,”

Rod Drury

Whatever the cause of your cash flow gap, it’s now easier than ever to solve it. Fuelled and Xero make it simple, giving you access to an on-demand cash flow source that is able to grow with your business.

It takes seconds to register and you find out in minutes how much cash flow you can access.

See you at www.fuelled.co.nz.

[1] The Kaplan Group, Alternative Financing Landscape, 2016

Say goodbye to 30|60|90 day payment terms

Fuelled helps small businesses grow by funding their outstanding invoices online. No meetings, no personal guarantees, no third degree.

The post The Rise of Alternative Finance in NZ appeared first on Fuelled.

]]>