How does Fuelled work?

No Meetings, No Paperwork, No Third Degree

Fuelled funds up to 90% of your qualifying invoices through a very quick online process.

How does repayment work?

Repayment is simple. At the time of funding your invoice you accept a quote based on the due date.

Once this date rolls around we take away the hassle by scheduling a Direct Debit from your account to Fuelled for the total repayment amount.

So you pay us back right after your customer pays you.

What about late paying customers?

We know from time to time things happen that are out of your control and we want to be able to help. All we need is a heads up that the payment is going to be late and we can recalculate the new fee and reschedule the new due date. Please note that conditions may apply.

What are the repayment fees?

There is a funding fee for each invoice, consisting of a 4% transaction fee and 15% per annum interest. Fees may apply for late payment and extensions. See Pricing for details.

Can I pay Fuelled back early?

Yes you can, and we won’t charge you any extra for doing so. Even better, we’ll recalculate a reduced fee reflecting the new time frame for the funding.

Visit our FAQ’s for more information.

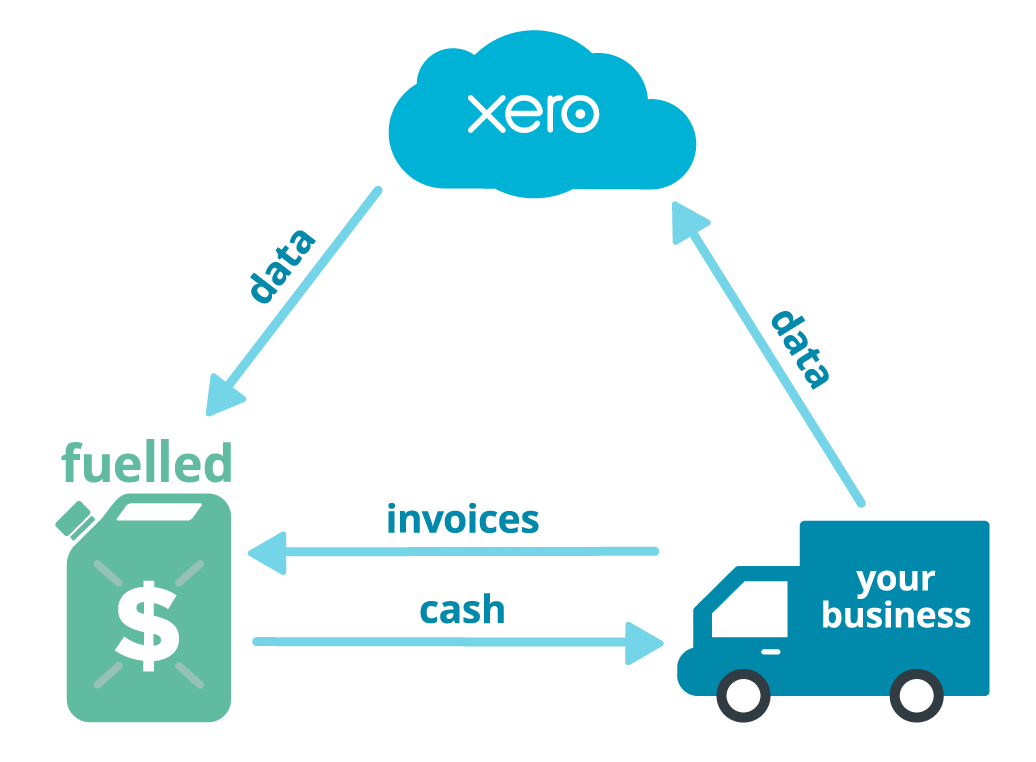

Access cash flow on your terms

Plugging gaps in cash flow can be stressful and complicated. But by linking up with Xero, Fuelled makes the process quick, painless and transparent.

Is Fuelled the right solution for my business?

To ensure Fuelled is the right solution for your business, we’ve designed a quick online assessment by linking us to your Xero account.

We are looking for:

The duration of financial history available in your Xero account.

Your total revenue during the last 12 months

The financial health and credit history of your business

Your relationship with your customers